Changes in the Role of Financial Managers

Considering the technological revolution, the role of financial managers has changed to a significant extent. The historical perspective of financial managers was to keep a record of every transaction and prevent financial misconducts in the organization to sustain in the markets for the long run profitably (Eleje, Okoh & Okoye, 2018). However, technological disruption has facilitated the financial sector to a significant extent. At the same time, technological disruption also holds adverse effects that hinder the organization’s sustainability in different markets. Using the technology to get maximum advantages in different markets has become a major opportunity for financial managers and organizations to avail.

Figure 1: Finance Managers & Technology

Source: (Tervala et al., 2017)

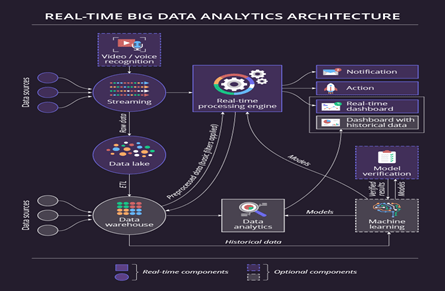

Using real-time analytics and big data analysis strategies with the help of artificial intelligence, financial managers can invest in fruitful and high-return based market. Apart from the advantages, technology has also raised certain challenges for organizations (GOV UK, 2018). Since the organizations have become more inclined towards digital bookkeeping system and online monetary transactions, the complications for financial managers have grown heavily. In different cultures, the magnitude of financial misconducts is dealt with strictly (ILO, 2017).

Figure 2: Real Time Analysis

Source: (Briggeman et al., 2019)

Developed and strong corporate governance-based countries such as the USA and UK have aggressive policies against organizations involved in misconducts, which depicts that the issue is considered ethically and morally wrong in different cultures (Yeoh, 2019). The implications for social entrepreneurs and society have also grown heavily as financial misconducts might motivate certain individuals and there is a high probability that fraud would increase. By now finance managers have to maintain presence at different areas of the organization including finance department, management system, HR system and capital budgeting department, which means technological has made the role of finance managers fragmented.

Although, I am not a finance manager and have limited knowledge about financial transactions. However, I would like to explain a situation where I got scammed by a random person online. I was trading my game inventory to an online website where I could sell my items for the money. In between the process of trading, someone scammed my trading system, and I ended up trading items with the scammer. The issue faced by me caused me to think about how difficult the role of financial managers has become. I could not carry out one transaction successfully and carefully, and financial managers have to keep an eye of huge monetary investments. However, technology can also be used in a positive manner where adoption of software and technology dependent framework be used to increase efficiency and productivity in the organization. Considering the technological disruption, the role of financial managers has been changed, which is expected to change even more in the future.

Possible changes in the Future:

The number of financial misconducts has grown to a significant extent. Considering the technological disruption, financial managers are bound to devise certain ways to resolve the issue. The concept of remote working is a major thing to consider here. I believe that for a single manager keeping an eye on financial transactions is challenging and highly risky. So, the organizations have to come up with the idea to prevent the misconducts. In this debate, the system of the remote transaction is a key thing to consider. Remote working is artificial intelligence (further referred to as AI) based system which enables the management to keep a record of work or transactions in the organization (Felstead & Henseke, 2017).

Figure 3: Remote Learning:

Source: (Felstead & Henseke, 2017)

There is an internally connected system which enables two-way learning. The work done by employees is systematically shared with the management. Considering its ability to keep managers aware of the work and transactions, it is expected that the role of financial managers will change to a significant extent. In an interview with Andy Stanford Clark, he mentioned that for fresh graduates possessing a skilled and adaptive mind is necessary. Clark further added that in order to survive in the modern age, individuals have to focus on digital learning. By the statement provided by Clark, it is evident that the world will be dominated by artificial intelligence and digital operations in the future. According to McKinsey’s Global Institute (further referred to as MGI) by 2030, more than 25% of work done in various genres of the organization will be done digitally (Manyika et al. 2017). The study conducted by MGI provides a detailed and critical insight into how things are likely to be changed in the future. The research conducted by MGI also supports the idea of remote-based learning and transactions system. According to the idea, financial managers would rely upon the use of technology to keep a record of transactions and to limit the growth of financial misconducts to a significant extent. The research conducted by MGI supports the point; hence, it can be interpreted that the technology would take over the financial bookkeeping, maintenance and check and balance systems. The financial managers of countries around the globe would rely upon the use of digital technology to a significant extent which will limit the growth of financial misconducts. Considering the change, the financial managers will have to re-skill and relocate their strong suits.

References:

Briggeman, B., Dikeman, M., Yeager, E., & Reid, R. (2019). A ProfitLink Decision Tree for Farm Financial Managers. The Journal of the ASFMRA, 115-120.

Eleje, E. O., Okoh, J. I., & Okoye, L. U. (2018). Computer-based financial reporting and transaction processing system in the Nigerian banking industry: The role of financial managers. Sokoto Journal of· Management Studies, 14(1), 212-230.

Felstead, A., & Henseke, G. (2017). Assessing the growth of remote working and its consequences for effort, well‐being and work‐life balance. New Technology, Work and Employment, 32(3), 195-212.

GOV, UK (2018). The future of work: jobs and skills in 2030, Retrieved from: https://www.gov.uk/government/publications/jobs-and-skills-in-2030

ILO (2017). Inception Report for the Global Commission on the Future of Work. Retrieved from: https://www.ilo.org/global/topics/future-of-work/publications/WCMS_591502/lang–en/index.htm

Manyika, J., Lund, S., Chui, M., Bughin, J., Woetzel, J., Batra, P., Ko, R. & Sanghvi, S. (2017). Jobs lost, jobs gained: What the future of work will mean for jobs, skills, and wages, retrieved from: https://www.mckinsey.com/featured-insights/future-of-work/jobs-lost-jobs-gained-what-the-future-of-work-will-mean-for-jobs-skills-and-wages

Tervala, E., Laine, T., Korhonen, T., & Suomala, P. (2017). The role of financial control in new product development: empirical insights into project managers’ experiences. Journal of Management Control, 28(1), 81-106.

Yeoh, P. (2019). Workplace Non-Financial Misconduct: Problems and Solutions. Business Law Review, 40(3), 101-110.

Hi Jiawen,

First of all, this is a great post! I enjoyed knowing more about your point of view about how digital technologies can affect financial transactions! I believe that digital technologies brought so much to this world and especially to the financial area. Now, financial transactions are instant and we have new tools to analyse data and develop new strategies: the process becomes easier and I believe that it is likely that anyone could use new technologies to manage their finance instead of using the services of consultants.

However, I think new digital technologies are also adding a risk to this area: the possibility that hackers could take profit from this progress is very scary!

LikeLike

This is an entirely new topic for me, and I find it very interesting. Thanks for the significant input Jia Wen. I agree that technologies have brought numerous benefits to online financial transactions. For example, big data not only help financial managers to engage in higher profit investment markets but also opens up more online opportunities if they have the knowledge and capabilities in relevant areas. New strategies can be developed to enhance and boost transactions and make processes more accessible and more effective.

However, I think the disruption of technologies has created many potential risks than benefits as more financial managers can utilize loopholes and grey areas in these online transactions to obtain personal gains. These misconduct behaviours could be devastating to the company itself, its customers, and even the community and economy. More importantly, technologies have opened up the opportunity for hackers to acquire specific information which is kind of impossible to avoid. In the future, there is no doubt that there will be more financial managers using technologies. But at the same time, suggesting that companies will have to put more effort into monitoring and ensuring the safety of their information becoming leaked online.

LikeLiked by 1 person